As we delve into Travel Insurance Comparison 2025: Policies Worth Considering, we uncover the dynamic landscape of travel insurance and the key factors shaping it for the future. Let's embark on a journey to explore the evolution of policies, emerging trends, and the essential aspects to keep in mind when selecting the right coverage.

Introduction to Travel Insurance Comparison 2025

Travel insurance plays a crucial role in ensuring financial protection and peace of mind for travelers in 2025. With the uncertainties and risks associated with traveling, having the right insurance coverage can mitigate unexpected expenses and emergencies.

Over the years, travel insurance policies have evolved to cater to the changing needs of travelers. From basic coverage for trip cancellations and medical emergencies, policies now offer a wide range of benefits such as coverage for adventure sports, natural disasters, and even pandemics.

The Significance of Comparing Travel Insurance Policies

It is essential to compare travel insurance policies to find the most suitable coverage at the best value. By comparing policies, travelers can ensure they are getting the right level of coverage for their specific needs, whether it be for a leisurely vacation or a business trip.

Factors to Consider When Comparing Travel Insurance Policies

When comparing travel insurance policies, there are several key factors that travelers should take into consideration to ensure they have the appropriate coverage for their needs. Understanding how coverage limits, deductibles, exclusions, and pre-existing conditions can impact policy selection is crucial for making an informed decision.

Coverage Limits

Coverage limits refer to the maximum amount an insurance policy will pay out for a covered claim. It is essential to evaluate whether the coverage limits offered by a policy align with your travel needs. For example, if you are planning a trip with expensive equipment or activities, you may need higher coverage limits to adequately protect yourself in case of loss or damage.

Deductibles

Deductibles are the amount of money you are required to pay out of pocket before your insurance coverage kicks in. Understanding the deductible amount and how it applies to different types of claims can help you determine the overall cost of the policy.

It is important to choose a deductible that you can comfortably afford in the event of a claim.

Exclusions

Exclusions are specific situations or circumstances that are not covered by the insurance policy. It is crucial to carefully review the list of exclusions to understand what risks are not protected under the policy. This will help you identify any gaps in coverage and decide if additional coverage is needed for certain activities or scenarios.

Pre-existing Conditions

Pre-existing conditions are medical conditions that exist before the start date of the insurance policy. Travel insurance policies may have different rules regarding pre-existing conditions, so it is essential to disclose any relevant medical history during the application process. Understanding how pre-existing conditions are handled by the policy can prevent any issues with claims related to existing health conditions.

Emerging Trends in Travel Insurance for 2025

Travel insurance is evolving to meet the changing needs of travelers, with new trends shaping the industry in 2025. Technology plays a significant role in this transformation, enabling innovative features that are becoming increasingly popular in travel insurance offerings.

Integration of Artificial Intelligence (AI) and Machine Learning

AI and machine learning are revolutionizing the way travel insurance policies are created and managed. Insurers are leveraging these technologies to streamline claims processing, personalize policy recommendations, and enhance customer service.

- AI-powered chatbots provide instant assistance to travelers, answering queries and guiding them through the claims process.

- Machine learning algorithms analyze vast amounts of data to identify trends and patterns, allowing insurers to offer more tailored and competitive policies.

- Automated underwriting processes speed up policy issuance, making it easier for travelers to obtain coverage quickly.

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-go or on-demand insurance, is gaining popularity in the travel insurance sector. This innovative approach allows travelers to pay premiums based on their actual travel activities and duration, providing more flexibility and cost-effectiveness.

- Travelers can activate coverage only when needed, such as during specific trips, reducing the overall cost of insurance.

- Insurance providers offer customizable plans that cater to individual travel preferences, ensuring travelers pay for the coverage that aligns with their needs.

- Real-time tracking and monitoring systems enable insurers to adjust coverage and pricing based on the traveler's location and activities, offering dynamic protection.

Cyber Insurance for Travelers

With the increasing prevalence of cyber threats and data breaches during travel, cyber insurance is emerging as a crucial component of travel insurance policies in 2025. This coverage protects travelers against cyber risks such as identity theft, online fraud, and data loss while traveling.

- Insurers offer reimbursement for financial losses incurred due to cyber incidents, including unauthorized transactions and ransomware attacks.

- Cyber insurance extends coverage to digital devices, ensuring travelers are protected against data breaches on smartphones, laptops, and other gadgets.

- 24/7 cyber assistance services provide travelers with immediate support in case of cyber emergencies, helping them mitigate risks and recover from cyber incidents effectively.

Comparison of Top Travel Insurance Providers

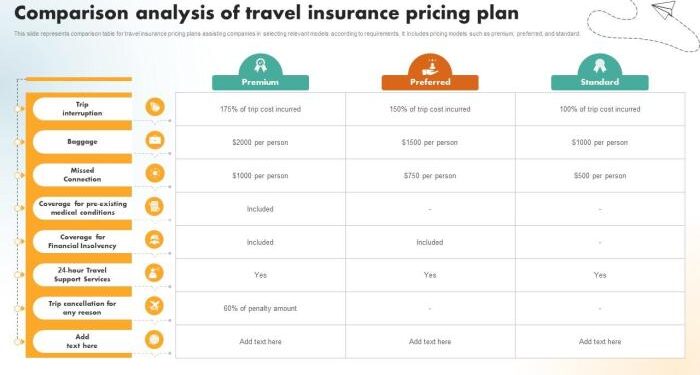

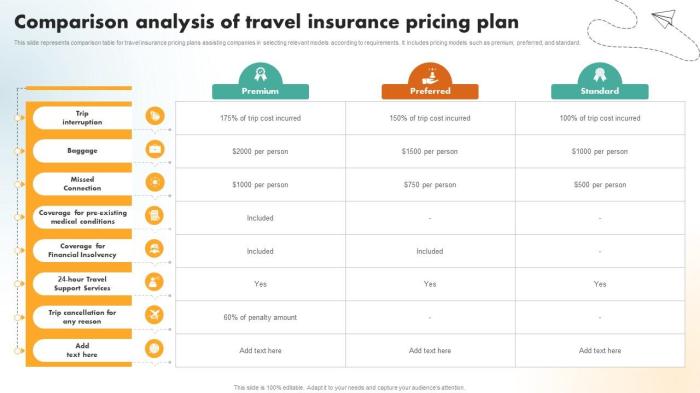

When choosing travel insurance, it's essential to compare policies from leading providers to ensure you get the coverage you need. Below is a table comparing policies from some of the top travel insurance providers, highlighting their coverage details, pricing, customer reviews, and additional benefits.

Allianz Global Assistance

| Coverage Details | Pricing | Customer Reviews | Additional Benefits |

|---|---|---|---|

| Emergency medical coverage, trip cancellation, baggage loss | Competitive rates with customizable options | High customer satisfaction ratings | 24/7 travel assistance, concierge services |

Travel Guard

| Coverage Details | Pricing | Customer Reviews | Additional Benefits |

|---|---|---|---|

| Trip interruption, emergency medical coverage, rental car damage | Varied pricing options based on coverage level | Positive reviews for quick claims processing | Global travel assistance, lost luggage reimbursement |

Travelex Insurance Services

| Coverage Details | Pricing | Customer Reviews | Additional Benefits |

|---|---|---|---|

| Trip cancellation, emergency medical coverage, baggage delay | Flexible pricing with optional add-ons | Good customer service reputation | Travel assistance services, coverage for pre-existing conditions |

Case Studies and Examples of Travel Insurance Claims

When it comes to travel insurance, understanding how different policies respond to real-life incidents is crucial. Let's take a look at some case studies and examples of successful travel insurance claims to see the importance of reading the fine print in travel insurance policies.

Example 1: Lost Luggage

- An individual traveling abroad had their luggage lost by the airline.

- They filed a claim with their travel insurance provider, which covered the cost of replacing their belongings.

- However, the policy had specific limits on the amount reimbursed for lost luggage, highlighting the importance of understanding coverage limits.

Example 2: Trip Cancellation

- A family had to cancel their vacation due to a sudden illness.

- Their travel insurance policy included trip cancellation coverage, reimbursing them for non-refundable expenses such as flights and accommodations.

- By carefully reviewing the policy details, they avoided financial losses from the unexpected cancellation.

Example 3: Medical Emergency

- While traveling overseas, an individual required emergency medical treatment.

- Their travel insurance policy covered the medical expenses, including hospital bills and evacuation costs.

- Understanding the extent of medical coverage in the policy ensured they received the necessary care without incurring substantial out-of-pocket expenses.

Final Wrap-Up

In conclusion, Travel Insurance Comparison 2025: Policies Worth Considering presents a comprehensive guide to navigating the world of travel insurance, equipping travelers with the knowledge needed to make informed decisions and ensure a worry-free journey ahead.

FAQ Guide

What are the key factors to consider when comparing travel insurance policies?

Travelers should consider coverage limits, deductibles, exclusions, and understanding how pre-existing conditions affect coverage.

What are the emerging trends in the travel insurance industry for 2025?

New trends include advancements in technology shaping policies and innovative features gaining popularity in offerings.

Can you provide examples of successful travel insurance claims?

Real-life case studies showcase how different policies respond to travel-related incidents, emphasizing the importance of reading policy details.